Investment and profitability

The minimum amount for investing in "DSK Dynamics" units is BGN 1,000 (one thousand). In the case of multiple periodic purchases of units through the "DSK Investment Plan", the minimum transaction is BGN 300.

The minimum value of the redemption of DSK Dynamics units is BGN 1,000. If the value of the units owned by the investor is less than BGN 1,000, he can sell them back to the Fund with one order. If, after execution of a buyback order, the remaining units of the investor are worth less than BGN 600 (six hundred), the order should be submitted for all available units.

You can invest in the Fund both through one-time purchases of units and through multiple periodic purchases, according to parameters determined by you (period, amount, date of purchase) through the automatic "DSK Investment Plan" service.

The fund has been created for investors who have a medium-term investment horizon and are looking for an investment that can realize a return that exceeds the return of the Reference index, while taking moderate to high risk.

When managing the Fund's portfolio, the aim will be to achieve a yield exceeding the yield of the reference index, regardless of the movement of the financial markets. The Reference Index reflects the change in 12M EURIBOR plus 1 (one) per cent and is calculated according to the formula specified in the Section "Cost Information, Annual Operating Expenses" of the Fund's Prospectus.

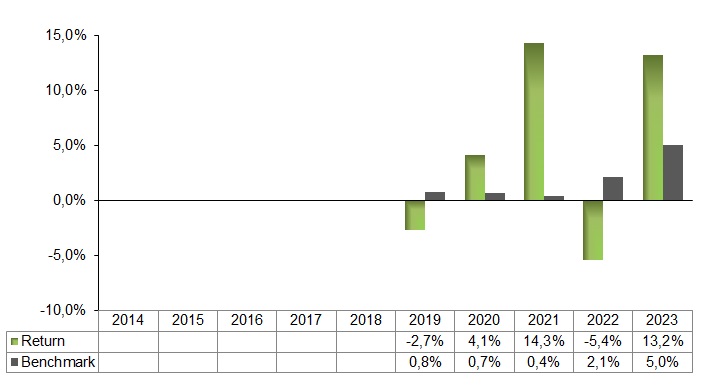

Reference Index data for a period

These results can help you assess how the Fund has been managed in the past.

The Fund's results for past periods are based on the percentage change in the net asset value per unit in BGN. Results are presented net of current fees. Initial charges and withdrawal charges are not included in the calculation.

The fund was established in July 2018 and started issuing units in August 2018.

Investors should have in mind that the value of the funds’ units and the income from them may decrease, the profit is not guaranteed and they take up the risk of not recovering their investment in full. Before making a final investment decision, it is advisable for investors to familiarize themselves with the Prospectus and the Key Information Document of the respective fund. The documents are in Bulgarian and they are available on the website of DSK Asset Management AD (www.dskam.bg), and upon request can be obtained free of charge on paper at the office of the Management Company or at the offices of the DSK Bank AD, designated as a distribution point, every working day within their working hours.